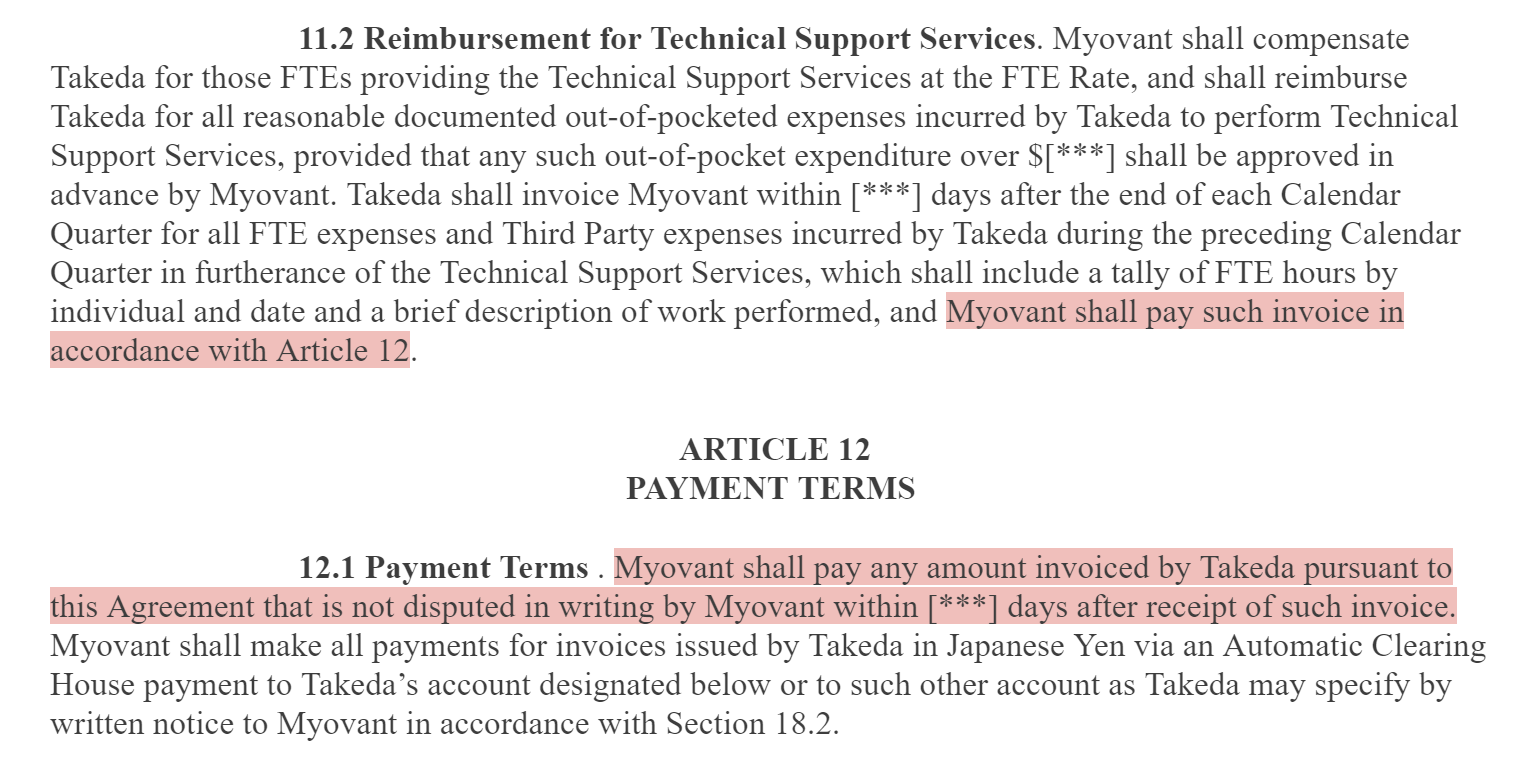

Check out the highlighted sentences:

Section 12.1 says how Myovant is required to pay invoices. Section 11.2 says Myovant is required to pay a given invoice in accordance with 12.1. In other words, section 11.2 imposes an obligation to comply with an obligation.

If it were somehow unclear whether section 12.1 applies to section 11.2, it would be prudent to make the connection clear. Or if the two sections were in different parts of the contract, it might be appropriate to remind the reader of the connection. But imposing an obligation to comply with an obligation never makes sense. Instead, say that section 12.1 applies to section 11.2.

In this case, it would be redundant to say that section 12.1 applies to section 11.2, given that the connection is clear and given how close the two sections are to each other.

Do you see enough of this sort of thing for me to take a closer look at it? Can you give me any examples? It could occur with other categories of contract language too.

Not sure I agree. On the topic of payment there are 3 main components:

1. The calculation of the amount payable (fees, expenses or whatever). A figure or formula etc. This does not in itself create the obligation – just method of calculation. There is no liability until there is an invoice (which is the payee’s right, which in theory, it can choose not to exercise).

2. Invoicing arrangements that trigger liability (no invoice, no liability to pay). This might cover method of invoicing (any formalities, where you send the invoice etc.), when (frequency etc) and how much of the fees is to be included in each invoicing. You might sometimes include a process for disputing invoices.

3. Payment arrangements – when they become due, including (maybe) any rights of the payer to extend. The contract would indicate consequences of late payment, and you can’t know whether payment is late unless you know the due date. It may also include payment processes.

In the example above, A11 seemed to cover 1 & 2 (clumsily), and A12 seemed to cover 3. The last sentence in A11 signposts the payment arrangements to A12 to tell the reader where to look. Maybe that’s helpful to the reader to provide that signpost.

Whether these 3 items belong in the same Article or not – shrug – but they are distinct issues.

The thing I’d add to this list is how to handle invoice disputes.I’ve seen a lot of provisions that relieve the customer of liability for payment based on the customer disputing the invoice (perhaps limited by good faith). That makes no sense. Whether the customer has liability is an objective issue that shouldn’t be based on whether the customer believes it has liability or not. I can see a provision saying that the customer won’t be liable for late payment fees or interest on amounts timely disputed, or one saying that the vendor can’t terminate for breach if the customer timely disputes (until the dispute is resolved), and even one saying that the time to pay any undisputed remainder doesn’t start running until the vendor provides separate invoices for the disputed and undisputed portions.